What forex traders should actually know about MetaTrader 4

Why traders still pick MT4 over newer platforms

MetaQuotes stopped issuing new MT4 licences a while back, steering brokers toward MT5. Still, most retail forex traders stayed put. The reason is straightforward: MT4 works, and people trust what works. Thousands of custom indicators, Expert Advisors, and community scripts run on MT4. Switching to MT5 means rewriting that entire library, and the majority of users don't see the point.

After testing both platforms side by side, and the gap is marginal for most strategies. MT5 has a few extras such as more timeframes and a built-in economic calendar, but chart functionality is nearly identical. Unless you need MT5-specific features, MT4 is more than enough.

Getting MT4 configured properly the first time

Installation takes a few minutes. What actually causes problems is getting everything configured correctly. By default, MT4 opens with four charts tiled across the screen. Clear the lot and open just the instruments you actually trade.

Templates are worth setting up early. Set up your preferred indicators on one chart, then save it as a template. After that you can load it onto other charts without redoing the work. Sounds trivial, but over time it makes a difference.

Something most people miss: open Tools > Options > Charts and tick "Show ask line." By default MT4 displays the bid price on the chart, which can make buy entries seem misaligned until you realise the ask price is hidden.

How reliable is MT4 backtesting?

MT4's built-in strategy tester allows you to run Expert Advisors against historical data. That said: the quality of those results depends entirely on your tick data. The default history data from MetaQuotes is interpolated, meaning gaps between real data points are estimated using algorithms. For anything that needs accuracy, download proper historical data.

That quality percentage in the results matters more than the headline profit number. If it's under 90% indicates the results shouldn't be taken seriously. I've seen people share screenshots with 25% modelling quality and ask why live trading looks different.

This is one area where MT4 genuinely outperforms most web-based platforms, but the output is only useful with quality tick data.

Custom indicators on MT4: worth the effort?

MT4 ships with 30 standard technical indicators. The average trader uses maybe a handful. But the platform's actual strength lives in community-made indicators built with MQL4. There are over 2,000 options, ranging from basic modifications to full trading dashboards.

Installing them is straightforward: copy the .ex4 or .mq4 file into your MQL4/Indicators folder, reboot MT4, and you'll find it in the Navigator panel. The catch is quality control. Publicly shared indicators vary wildly. A few are genuinely useful. Many are abandoned projects and will crash your terminal.

If you're downloading custom indicators, check how recently it was maintained and if other traders report issues. Bad code won't just give wrong signals — it can slow down MT4.

The MT4 risk controls you're probably not using

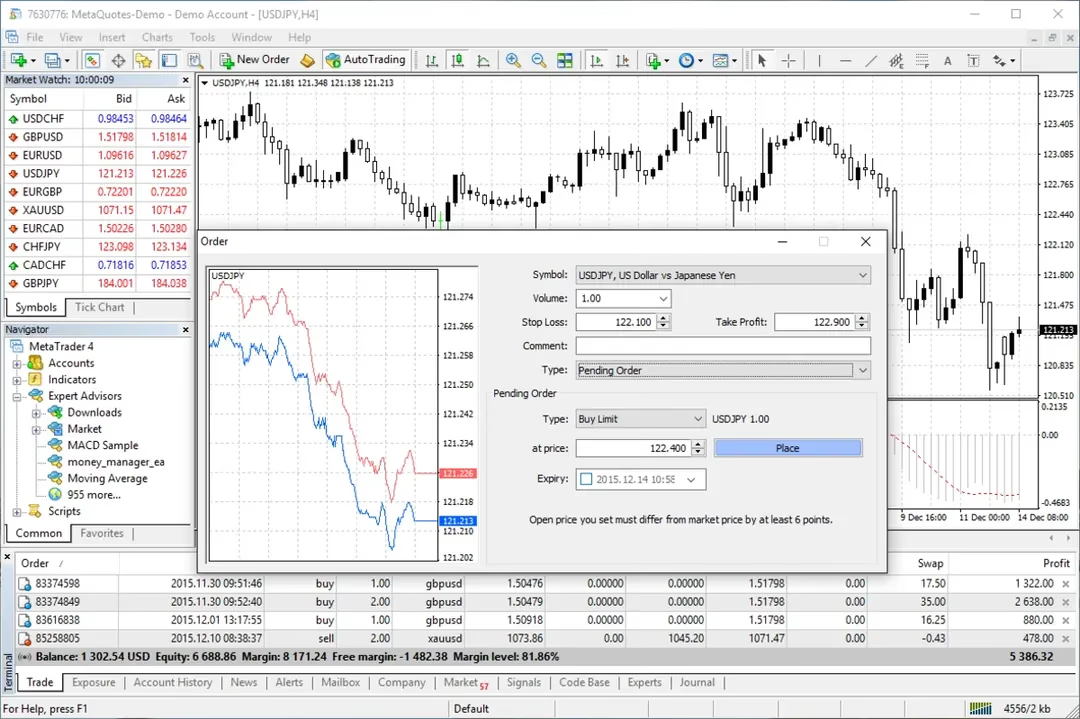

You'll find several built-in risk management options that the majority of users skip over. Probably the most practical one is maximum deviation in the new order panel. This defines the amount of slippage is acceptable on market orders. If you don't set it and you'll get whatever price is available.

Stop losses are obvious, but the trailing stop function is overlooked. Right-click an open trade, choose Trailing Stop, and enter your preferred distance. Your stop loss adjusts with price moves your way. It won't suit every approach, but on trending pairs it removes the temptation to micromanage the trade.

You can configure all of this in under five minutes and they remove a lot of the emotional decision-making.

EAs on MT4: what to realistically expect

Expert Advisors on MT4 attract traders for obvious reasons: set rules, let the code trade, walk away. In reality, most EAs fail to deliver over any decent time period. The ones marketed using incredible historical more results are often fitted to past data — they performed well on past prices and fall apart when the market does something different.

This isn't to say all EAs are a waste of time. Certain traders code personal EAs to handle well-defined entry rules: opening trades at session opens, managing position sizing, or closing trades at set levels. That kind of automation tend to work because they do mechanical tasks without needing interpretation.

When looking at Expert Advisors, test on demo first for no less than a few months. Live demo testing is more informative than historical results ever will.

Using MT4 outside Windows

MT4 was built for Windows. Running it on Mac has always been a workaround. Previously was running it through Wine, which mostly worked but came with display glitches and stability problems. Certain brokers now offer Mac-specific builds built on Crossover or similar wrappers, which is an improvement but still aren't true native apps.

MT4 mobile, available for both iPhone and Android, are surprisingly capable for keeping an eye on your account and managing trades on the move. Doing proper analysis on a 5-inch screen isn't realistic, but managing exits on the go has saved plenty of traders.

Look into whether your broker has real Mac support or a compatibility layer — the difference in stability is noticeable.